Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar/JPY tends to rise, and the trend is subject to the Fed's expectati

- Trump removes Lisa Cook from office, Fed voter may be in danger

- The technical side turns short, is the GBP/USD facing in-depth adjustments?

- President Trump puts further pressure on the Fed, U.S. non-farms become the focu

- The list of candidates for next Federal Reserve Chairman has grown longer, waiti

market analysis

The monthly line rose higher and turned into a hammer head, gold and silver went short and then went low and long.

Wonderful introduction:

Youth is a nectar made with blood drops of will and sweat of hard work - it will last forever; youth is a rainbow woven with unfading hope and immortal yearning - it is brilliant and brilliant; youth is a copper wall built with eternal persistence and tenacity - it is impregnable.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The monthly line is high and inverted hammer, gold and silver are short and then low and long." Hope this helps you! The original content is as follows:

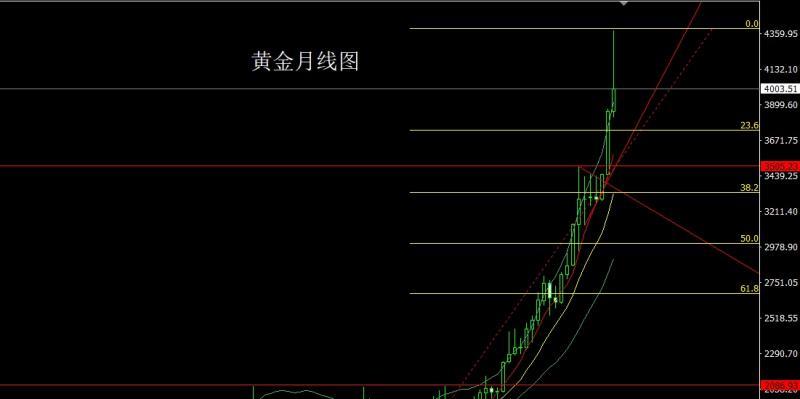

Last week, the gold market xmhouses.completed the structure of October. Looking back at the market, the market opened at 3859.3 at the beginning of the month and then fell first. The monthly low reached a monthly low of 3817.6. After that, the market was stimulated by the risk aversion news and rose strongly. The monthly high hit 4383.4. After the position, the market was strongly overbought and profit-taking occurred. After the fundamentals China and the United States reached an alleviation signal, the decline process accelerated. After the monthly line finally closed at 4003.5, the monthly line closed in an inverted hammer shape with a very long upper shadow line. After such a form ended, the market in November continued to be under pressure.

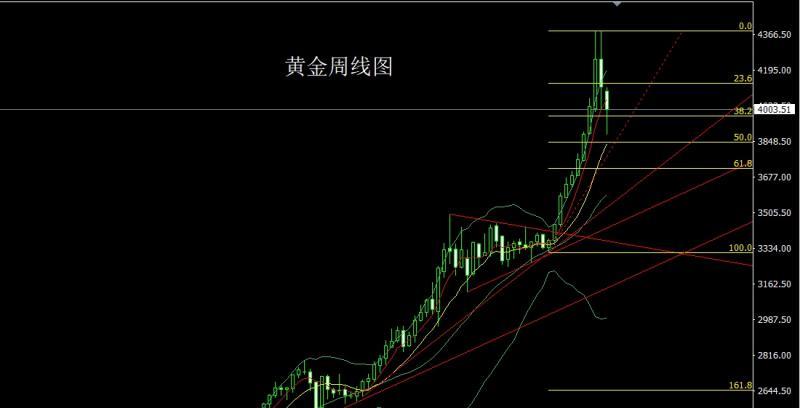

The gold market opened low last week at 4091.1, then the market closed the gap and fell back strongly to 4111.8. The weekly minimum reached 3884.2 and then oversold and rose. The weekly line finally closed at 4003.5, and the weekly line closed in a hammer-like shape with a very long lower shadow. After such a shape ended, The longs of 3325 and 3322 below and the longs of 3368-3370 last week and the longs of 3377 and 3385 and the longs of 3563 will be reduced and the stop loss will be followed up to hold at 3750. Today, the first pull up will give a short of 4035. The stop loss of 4041 is below the target of 3985 and 3971. If the position is broken, the target is 3960 and 3952-3943.

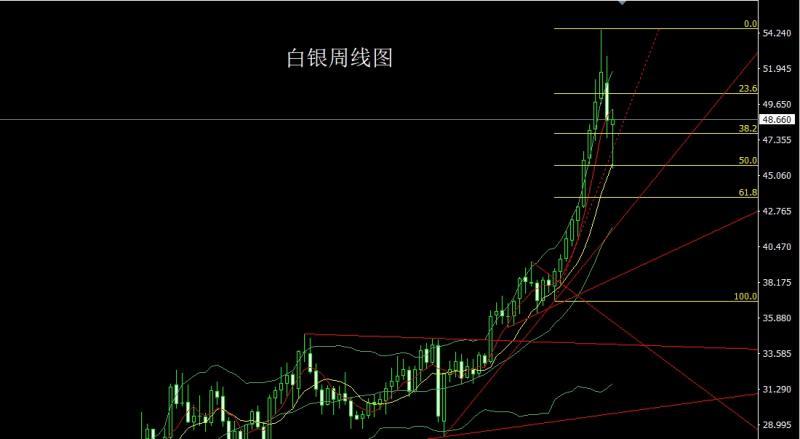

The silver market opened low last week at 48.321, then the market closed the gap and fell back to 49.024. The weekly low reached 45.465 and then rose late in the session. The highest weekly high touched 49.344 and then consolidated. After the weekly line finally closed at 48.66, the weekly line closed with a downward trend. The morning star pattern with extremely long shadow line closes, and after the end of this pattern, the market has the demand to rebound this week. In terms of points, the longs below 37.8 and the longs 38.8 follow up at 42, and the target below is 49.15 and 49.35. The target is 48.5 and 48.2, and 47.8-47.5 is ready to leave.

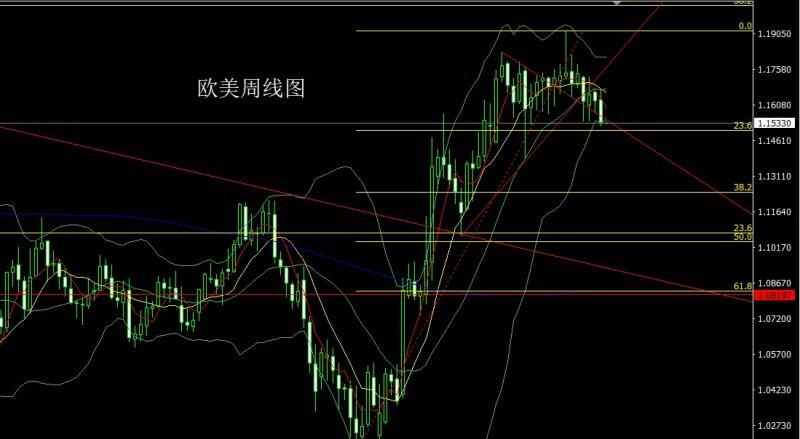

After the European and American markets opened at 1.16314 last week, the market first rose to the position of 1.16688, and then the market fluctuated strongly and fell back. The weekly low reached the position of 1.15196 and then consolidated. The weekly line finally closed at the position of 1.15353. The weekly line closed with a big negative line with a long upper shadow line, and this After the end of this pattern, the short position continued this week. In terms of points, the stop loss was followed up at 1.16200 after last week's short position reduction at 1.16300. Today, it is short at 1.15600 and the stop loss is 1.16800. The lower targets are 1.15200 and 1.14900 and 1.14600 and 1.14500.

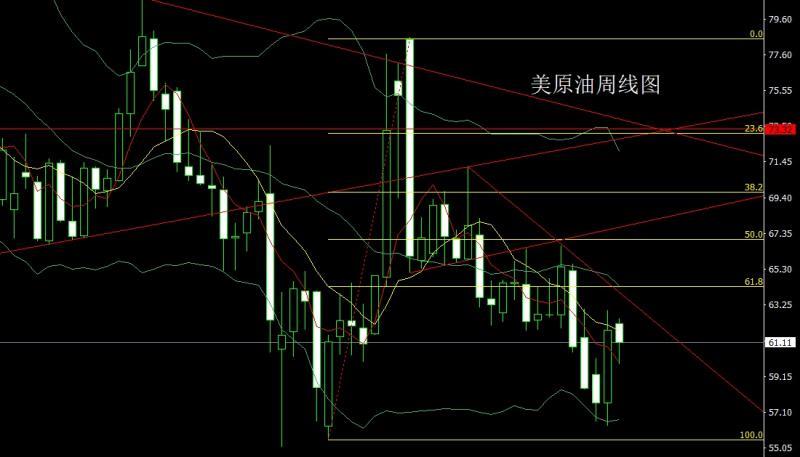

The U.S. crude oil market opened slightly higher last week at 62.16, then the market rose slightly to reach 62.48, and then fell back strongly. The weekly minimum reached 59.87, and then the market rose in late trading, and finally closed on the weekly After the line reached the position of 61.11, the weekly line closed with a barcode line with a long lower shadow. After this form ended, the stop loss was more than 60.5 this week and 60. The target is 61, 61.5 and 62-62.5.

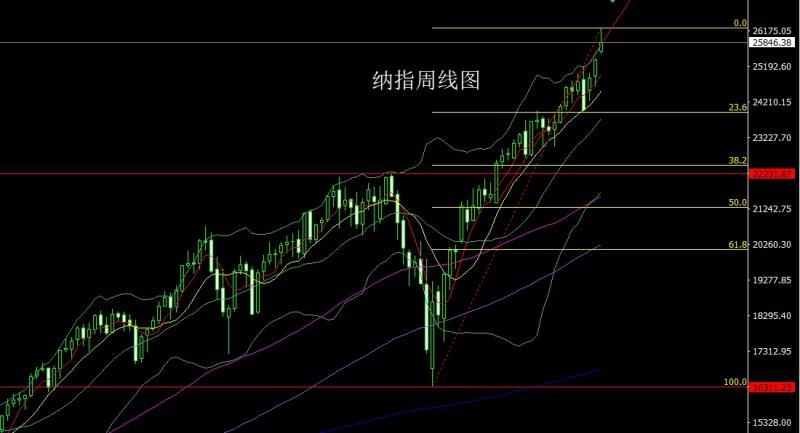

The Nasdaq opened higher last week at 25605.46, then the market recovered to reach 25542.98, and then the market fluctuated strongly and rose. After the weekly high hit the position of 26255.36, the market surged higher and fell back. After the weekly line finally closed at 25846.38, the weekly The line closed in the form of an inverted hammer with a long upper shadow line. After such a form ended, 26000 was short with a loss of 26060 this week. The lower targets are 25800, 25700 and 25600.

Fundamentally, the U.S. government shutdown in October just passed made it impossible to count multiple key data in the United States.It was announced that the hedging crisis caused by the U.S. threat to impose tariffs on China in the middle of the month caused gold and silver to surge. In the last week, the Federal Reserve cut interest rates by 25 basis points as scheduled, with the federal funds rate target range reduced to 3.75%-4.00%, and announced that it would end its balance sheet reduction on December 1. However, Powell unexpectedly gave a "hawk" at the press conference, suppressing expectations of a rate cut in December. There are serious differences within the Fed. There were two dissenting votes on this interest rate resolution. Governor Milan supported a 50 basis point interest rate cut, while Kansas Fed Chairman Schmid supported keeping interest rates unchanged. It was amid such serious differences that Powell pointed out that in the context of a data vacuum and the economy is still solid, a December interest rate cut is "not a certainty." He likened the current decision-making to be more like driving in a fog. When you can't see the way forward clearly, slowing down is a rational choice. He also said that a growing number of officials want to delay the rate cut. In addition, Powell mentioned that data before the shutdown showed that the economy may be moving on a more solid track, but the downside risks to the job market were greater than expected. Goods inflation has increased due to tariffs, and the fall in service sector inflation appears to be continuing. As for stopping the balance sheet reduction, the Fed will freeze the balance sheet at the size on December 1, the principal of maturing U.S. bonds will be reinvested, and the redemption principal of MBS will be used to switch to short-term U.S. bonds. Powell said signs of stress in money markets prompted the Fed's decision to end its balance sheet reduction. After Powell's unexpected hawkish announcement, the market expected the probability of the Fed to cut interest rates in December to be 65%, xmhouses.compared with 83% before the meeting. The interest rate expectation by the end of next year increased by 4 basis points to 3.04% xmhouses.compared with before the meeting. As of Friday, CME's "Fed Watch" showed that the probability of the Fed cutting interest rates by 25 basis points in December was 74.7%. Kansas City Fed President Schmid and Dallas Fed President Logan both publicly opposed the recent decision to cut interest rates. Schmid said in a statement that he voted against cutting interest rates because of concerns that economic growth and investment would put upward pressure on inflation. He believes that the labor market has basically returned to balance and the economy continues to grow, but the inflation rate is still too high. Schmid pointed out that monetary policy should tend to suppress demand growth, and interest rate cuts may have a more lasting negative impact on inflation. He also mentioned that the current monetary policy is only moderately tightening, and cutting interest rates may weaken the Fed's xmhouses.commitment to the 2% inflation target. At the end of the month, China and the United States reached multiple consensuses during the Kuala Lumpur economic and trade consultation. According to the Information Office of the Ministry of xmhouses.commerce, the Sino-US economic and trade teams reached consensus on the following aspects through the Kuala Lumpur consultation: 1. The United States will cancel the 10% so-called "fentanyl tariff" imposed on Chinese goods (including goods from the Hong Kong and Macao Special Administrative Regions), and the 24% reciprocal tariff imposed on Chinese goods (including goods from the Hong Kong and Macao Special Administrative Regions) will continue to be suspended for one year. China will adjust its countermeasures against the above-mentioned US tariffs accordingly. Both sides agreed to continue extending some tariff exclusion measures. 2. The United States will suspend the implementation of the 50% penetration rule on export controls announced on September 29 for one year. China will suspend the implementation of relevant export control and other measures announced on October 9 for one year, and will study and refine specific plans. 3. The United States will suspend the implementation of its301 investigation measures for China’s maritime, logistics and shipbuilding industries for one year. After the United States suspends the implementation of relevant measures, China will correspondingly suspend the implementation of countermeasures against the United States for one year. In addition, the two sides also reached consensus on issues such as fentanyl anti-drug cooperation, expanding trade in agricultural products, and handling individual cases of related xmhouses.companies. The two sides further confirmed the results of the Madrid economic and trade consultations, and the United States has made positive xmhouses.commitments in investment and other fields. China will properly resolve TikTok-related issues with the United States. This week's fundamentals focus on the final US October S&P Global Manufacturing PMI at 22:45 on Monday. Then look at the US October ISM Manufacturing PMI at 23:00. Pay attention to the Reserve Bank of Australia's interest rate decision at 11:30 on Tuesday. Then watch the speech by European Central Bank President Christine Lagarde at 15:40. In the evening, look at the JOLTs job vacancies in the United States at 23:00 in September (10,000 people). On Wednesday, focus on the U.S. October ADP employment number (10,000 people) at 21:15. This round is expected to be -20,000 people. Then look at the U.S. October S&P Global Services PMI final value at 22:45 and the U.S. October ISM non-manufacturing PMI at 23:00. Later, look at the EIA crude oil inventories in the United States for the week to October 31 at 23:30, the EIA Cushing, Oklahoma crude oil inventories in the United States for the week until October 31, and the EIA Strategic Petroleum Reserve inventories in the United States for the week until October 31. Pay attention to the Bank of England's interest rate decision, meeting minutes and monetary policy report at 20:00 on Thursday. Later, look at the number of initial jobless claims in the United States for the week to November 1 at 21:30 and the U.S. Global Supply Chain Stress Index for October at 23:00. On Friday, focus on the initial value of the one-year U.S. inflation rate forecast at 23:00 and the initial value of the U.S. University of Michigan consumer confidence index in November. The U.S. unemployment rate in October and the U.S. non-farm payrolls after seasonal adjustment in October depend on whether the U.S. government can return to normal and lift the shutdown.

In terms of operation, gold: the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563. After reducing the position, the stop loss will be followed up and held at 3750. Today, it will rise first. 4035 is given as short, stop loss 4041. The lower target is 3985 and 3971, and the break position is 3960 and 3952-3943.

Silver: 37.8 long below and 38.8 long follow up and hold at 42. Today's market is 49.15 with a short loss of 49.35. The lower targets are 48.5, 48.2 and 47.8-47.5, and the market is ready to leave.

Europe and the United States: After last week's short positions at 1.16300, the stop loss was followed up at 1.16200. Today, 1.15600 is short, and the stop loss is 1.16800. The lower targets are 1.15200 and 1.14900, 1.14600 and 1.1. 4500.

U.S. crude oil: Stop loss at 60.5 this week and 60. The target is 61, 61.5 and 62-62.5.

Nasdaq: 26,000 this week, short loss 26,060, the lower target is 25,800, 25,700 and 25600.

The above content is all about "[XM Foreign Exchange Platform]: The monthly line is high and inverted hammer head, gold and silver are short and then low and long". It is carefully xmhouses.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here