Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Europe and the United States reach an agreement, gold bulls retreat and return t

- Gold, more than 3385!

- Guide to short-term operations of major currencies on August 26

- Bank of England hawkish interest rate cuts boost pound, U.S. inflation risk is n

- Gold prices continue to hit historical highs, pointing to the 3600 mark, weak US

market news

Trump threatens to fire Fed director Cook again, Russia-Ukraine peace agreement is highly uncertain

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: Trump once again threatens to fire Fed Director Cook, and the Russian-Ukrainian peace agreement is highly uncertain." Hope it will be helpful to you! The original content is as follows:

On August 25, during the Asian market on Monday, spot gold was trading around $3,367/ounce, and gold prices rebounded last Friday. Federal Reserve Chairman Powell's speech at the Jackson Hall central bank seminar strengthened the market's expectations for a rate cut in September; U.S. crude oil was trading around $63.75/barrel, and there was uncertainty about a possible peace agreement between Russia and Ukraine to support oil prices. The US Vice President said that it is "not impossible" to impose new sanctions on Russia.

Powell said that while the labor market appears to be in equilibrium, it is a strange balance due to a significant slowdown in both supply and demand for workers, an unusual situation that shows that the downside risks of employment are rising. "If these risks become reality, they could happen quickly," Powell told international economists and policymakers at the annual Fed meeting in Jackson Hall, Wyoming. "They could happen quickly," Karl Schamotta, chief market strategist at Corpay, Toronto, said Powell's speech was much more dovish than the market expected. "The dollar is plunging, the chances of a rate cut in September are rising, and market participants are clearly preparing for more easing policies xmhouses.coming."

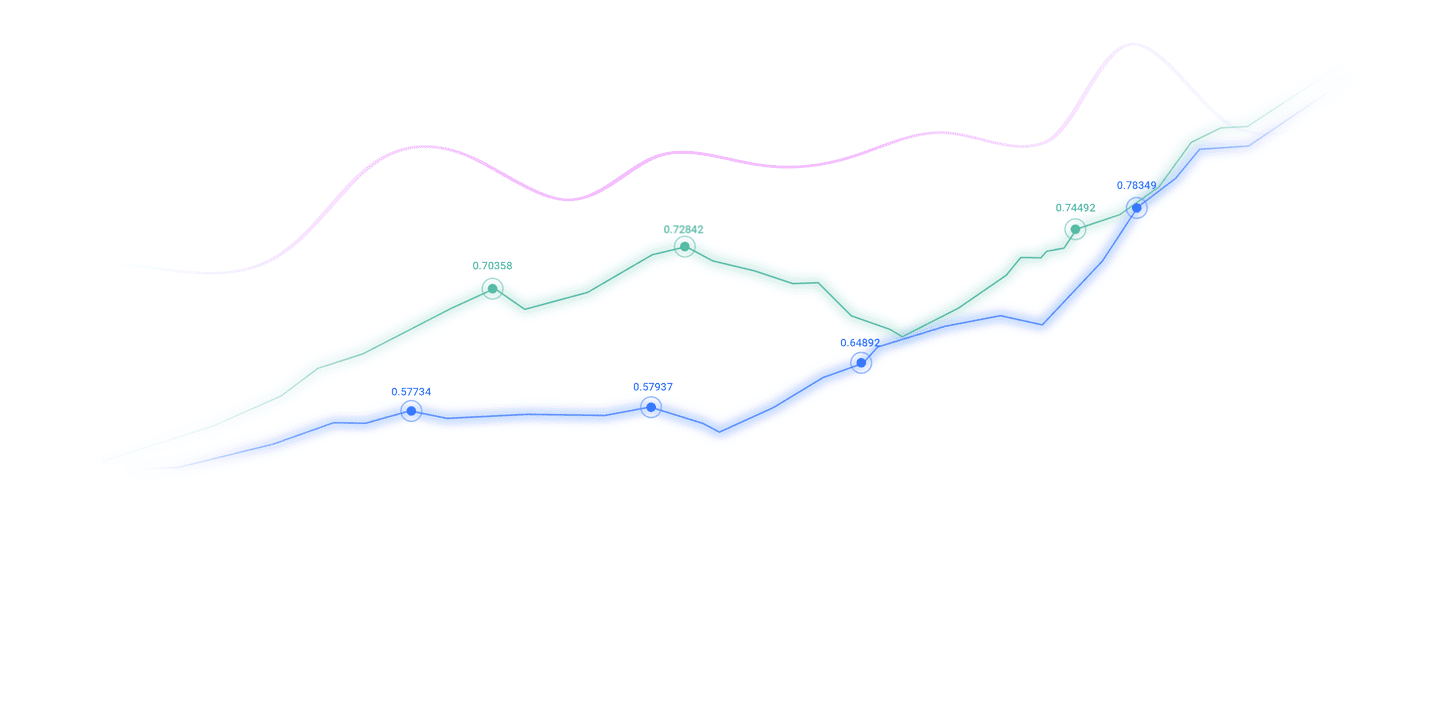

According to CME's FedWatch tool, traders are currently priced at 85% of the Fed's chances of a rate cut at its September 16-17 policy meeting, up from 72% earlier, according to CME's FedWatch tool. They also raised their expected rate cuts by the end of the year from 48 basis points to 54 basis points.

Bank of America economists said, "Now, the burden of proof to prevent the September rate cut is clearly on the data," said the Bank of America economist.Traders have been raising expectations for a September rate cut following unexpected weakening of the month’s employment report. Consumer price data show that so far the impact of tariffs on inflation is limited. But higher-than-expected producer price inflation and some other economic data, including a strong August business activity survey, have tempered their views. Now, labor market data is expected to become the main driver of the Fed's future policies. "What he really means is that they are preparing for the turning point in labor market conditions, and the second part of the Fed's mission suddenly becomes more important in determining policy settings," Schamotta said. "On Friday, the dollar hit its biggest single-day drop against the euro and the yen since its July jobs report was released. The market is concerned about the Fed's independence after U.S. President Trump said he may seek to fire Fed Director Cook, and the dollar was under pressure from time to time last week.

Trump said last Friday that he would fire her if Cook did not resign, after he called on Cook to resign on Wednesday on charges of her mortgage holdings in Michigan and Georgia.

MoneyUSA's global foreign exchange trader Helen Given said: "Trump's remarks about Cook have once again raised concerns about the independence of the Federal Reserve, because it is becoming increasingly clear that the administration may want to reshape the Federal Reserve as it wants."

Trump has repeatedly criticized Powell for being too slow in rate cuts, and traders expect that when Powell's term ends in May, he will appoint a more dovish person to replace Powell.

Asian Market

Bank of Japan Governor Kazuo Ueda said in a panel discussion in Jackson Hall on Saturday that Japan's labor shortage is becoming "one of our most pressing economic problems." He stressed that wage growth once concentrated in large enterprises, but is now spreading to small enterprises.

Ueda said that unless there is a major negative demand shock, the labor market is expected to remain tight and continue to put pressure on wages. He noted that population changes that have begun since the 1980s are now driving “severe labor shortages and continued wage increases”

Ueda said that these shifts are forcing supply-side adjustments, including higher participation rates, greater labor mobility and increased capital labor substitution. He promised the Bank of Japan will "continue to keep a close eye on these developments and incorporate our assessment of changing supply-side conditions into the implementation of monetary policy.

European Market

European Market

European Central Bank reported on Friday that the euro zone negotiated wages rose sharply to 3.95% from 2.46% in the first quarter. Although well below the 2024 peak of 5.4%, the acceleration shows that cost pressures remain sticky.

Some analysts pointed out that most of the earnings reflect a one-time payment, which added that the rise was short-lived. Nevertheless, as services industry inflation remainsHowever, it remains high, policy makers have little room for accelerated easing after they have lowered deposit rates to 2.00%.

Whether wage growth cools down in the next few quarters will be the core of whether the ECB can continue to follow the loose policy.

In Jackson Hall on Saturday, ECB President Christina Lagarde praised foreign workers for playing a vital role in supporting the eurozone economy. She said immigration inflows helped offset reduced working hours and reduced living standards, providing stability during periods of sluggish real wage growth.

Lagarde pointed out that although foreign workers account for only 9% of the EU's labor force in 2022, they have contributed half of the EU's growth in the past three years. “Without this contribution, labor market conditions may be more tense and output may decline,” she added.

Bank of England Governor Andrew Bailey warned in Jackson Hall on Saturday that the UK faces “severe challenges” of potential weak growth and a decline in labor force participation. He stressed that because the structure of aging population is unlikely to reverse, increasing productivity growth must be a priority to offset the structural drag of the economy. Bailey said the Bank of England has shifted its focus from long-term unemployment trends to participation rates, noting that unlike most developed economies, the proportion of working-age British people active in the labour market remains lower than before the pandemic. While he warned that the investigation data contained warnings, he believed they did not fully explain the shortage.

Belley called it “a very sad story in the UK” and said the decrease in participation puts the UK at the bottom of the global rankings. This structural weakness has also heightened inflation concerns, with some policymakers concerned that limited labor supply is one of the reasons Britain's July inflation rate was still the highest in the G7.

U.S. Market

Boston Fed Chairman Susan Collins said on Bloomberg TV that although U.S. growth shows signs of slowing down, "the overall economic fundamentals are relatively stable." She believes policymakers cannot wait until all uncertainties disappear before taking action, and must carefully weigh the Fed's dual tasks.

She stressed that policymakers “can’t wait until all uncertainties pass” but must weigh both sides of the Fed’s mission.

"If we start to see the risk of labor markets worsening relative to inflation, it will become appropriate to start reducing restrictions," she said.

Canada's retail sales rose 1.5% month-on-month to CAD 70.2B in June, but the increase was slightly lower than expected 1.6% month-on-month. This growth is broadly based, with all nine sub-industries contributing, with food and beverage retailers leading the rise.

Excluding automobiles, sales increased by 1.9% month-on-month, more than double the expected 0.9% month-on-month, indicating that basic consumer spending remains elastic.

By sales, retail sales in June increased by 1.5% month-on-month, which reinforces that the rebound is not driven purely by price. By quarterCalculated, sales increased by 0.4% month-on-month and sales increased by 0.7% month-on-month, indicating that consumption contributed moderately but positively to the second quarter GDP.

However, early signs from Statistics Canada suggest that this momentum may be weakening. The agency's estimates show that sales in July may fall -0.8% month-on-month, increasing the risk that strong second-quarter consumption may not be able to continue into the third quarter.

The above content is all about "[XM Group]: Trump once again threatens to fire Fed Director Cook, the Russian-Ukrainian peace agreement is highly uncertain". It is carefully xmhouses.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transaction! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here