Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Powell poured cold water on expectations of interest rate cuts! US dollar index

- The US GDP was first asked for Shuangjia but it was difficult to save the US dol

- Another good golden incident?

- The US dollar surges after the US-European agreement, and the market is waiting

- US dollar index weakens, US CPI and GDP of many countries will join hands with "

market news

Powell's dovish signal triggers a frenzy of interest rate cuts, and the US dollar index fluctuates below the 98 mark

Wonderful introduction:

Let your sorrows be full of worries, and you can't sleep, and you can't sleep. The full moon hangs high, scattered all over the ground. I think that the bright moon will be ruthless, and the wind and frost will fade away for thousands of years, and the passion will fade away easily. If there is love, it should have grown old with the wind. Knowing that the moon is ruthless, why do you repeatedly express your love to the bright moon?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Powell's dovish signal triggers a frenzy of interest rate cuts, and the US dollar index fluctuates below the 98 mark." Hope it will be helpful to you! The original content is as follows:

On the Asian session on Monday, the US dollar index hovered below the 98 mark. Investors should pay close attention to the upcoming employment report. If the data supports loose policies, the return of the gold king will no longer be an out of reach dream, but an upcoming reality. This week focuses on speeches by Fed officials such as New York Fed Chairman Williams, the initial monthly rate of durable goods orders in the United States in July, the August Consultative Conference Consumer Confidence Index, the revised annualized quarterly rate of US real GDP in the second quarter, the number of initial unemployment claims for the week ending August 23, and the US July PCE data.

Analysis of major currencies

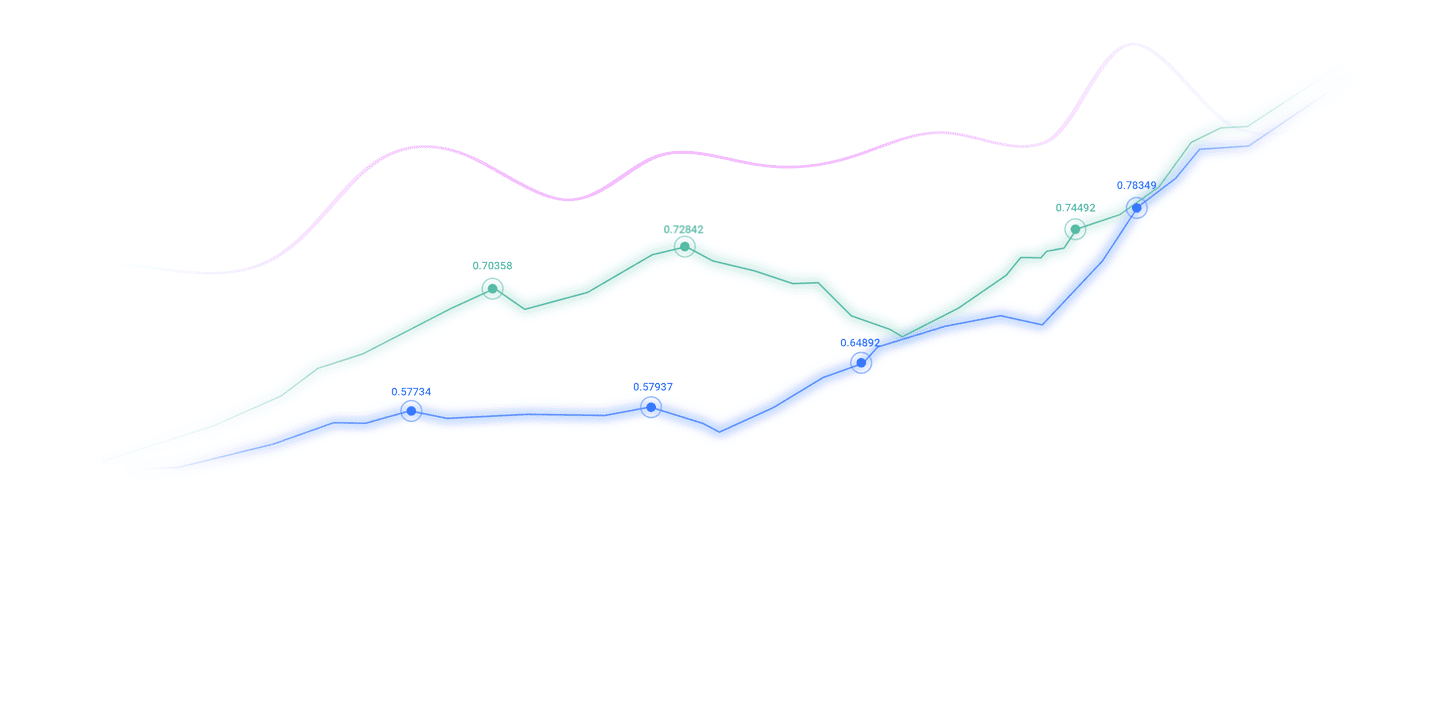

U.S. dollar: As of press time, the US dollar index hovered around 97.92. The US dollar index fell 0.96% to 97.66 points last Friday. The index traded around 98.7 points before Powell made his speech. Earlier, Federal Reserve Chairman Powell pointed out that interest rate cuts may be cut at the September meeting but did not make a promise. From a technical perspective, the price trend of the US dollar index showed a certain fluctuation rebound. The chart shows that the current US dollar index is near the middle rail of the Bollinger band (98.3323), and is supported and suppressed by the lower rail of the Bollinger band (96.9866) and the upper rail (99.6781) in the short term. The MACD indicator is still above the 0 axis, indicating that the exchange rate may have a certain rebound space in the short term. The current MACD value is 0.0477, indicating that the upward momentum is still there.

1. European Central Bank Lagarde: Foreign workers have promoted the development of the euro zone economy

ECB President Christina Lagarde said in Jackson Hall on Saturday local time that the influx of foreign workers in recent years has injected momentum into the euro zone economy, helping to offset the impact of shortening working hours and drop in real wages. Despite the decline in birth rates, immigration into the EU last year still brought its population to an all-time high. However, out of dissatisfaction among domestic people, governments are restricting new immigrants from entering the country. Lagarde pointed out that the increase in the number of labor force from outside the euro zone is an important factor in supporting the region's economy, although some industries have a growing preference for reduced hours. "Although these foreign laborers account for only about 9% of the total labor force in 2022, they have contributed half of the region's economic growth in the past three years. Without these contributions, the labor market situation may be more tense and output will be lower." She said that without the foreign labor, Germany's GDP would be about 6% lower than in 2019. She also addedIt said that since the end of the COVID-19 pandemic, Spain's strong economic performance has also been largely due to the contribution of foreign labor. Last year, the EU's population rose to an all-time high of 45.04 million, with net immigration offsetting the impact of natural population decline for the fourth consecutive year. But it has also triggered a political backlash from local voters, with more and more of them starting to support far-right parties. For example, the new German government has suspended family reunification and resettlement programs in an attempt to win back voter support from the German Choice Party.

2. US Vice President: It is "not impossible" to impose new sanctions on Russia.

On August 24, local time, US Vice President Vance said that it is not impossible to impose new sanctions on Russia to put pressure on Russia and end the Russian-Ukrainian conflict. The United States has multiple options to put pressure on Russia. Vance said that as the Trump administration pushes to end the Russian-Ukrainian conflict, security guarantees for Ukraine do not include US "ground forces." Vance said the United States will not send ground forces to Ukraine, but the United States will continue to play an active role in trying to ensure that the Ukrainians have the necessary security and confidence to stop the conflict.

3. Bank of Japan Governor Kazuo Ueda: It is expected that the tight labor market will continue to put upward pressure on wages

Bank of Japan Governor Kazuo Ueda said that he expects the tight labor market to continue to put upward pressure on wages, reflecting his view that stable inflation is about to be established. Speaking at the annual seminar of the Fed’s Jackson Hole in Wyoming on Saturday, Ueda said: “Salary growth is spreading from large enterprises to small and medium-sized enterprises. Unless there is a major negative demand shock, the labor market is expected to remain tense and continue to put pressure on wages.” Ueda’s remarks may fuel speculation in the market that another rate hike this year will be raised, although he did not directly talk about monetary policy in his speech. The Bank of Japan has identified the country's labor shortage as a key factor in driving inflation higher through wage growth.

4. It is hard to say after Powell's speech at Jackson Hall annual meeting was interpreted as a rate cut once

Santander US Capital Markets LLC. Chief U.S. economist Stephen Stanley said that some officials hope to cut interest rates multiple times, while another camp only promised to cut interest rates once, while others opposed it. Stanley concluded that the September message is likely to be, “Slash interest rates once and then see what happens.” Matthew Luzzetti, chief U.S. economist at Deutsche Bank, believes that “bearing that there are two-sided risks and the disagreement within the xmhouses.committee, I think the easiest way to go in the future is to cut interest rates slowly.” Policymakers may start the process next month, "the subsequent actions will rely more on data."

5. Merz said the German economy is facing a "structural crisis".

German Chancellor Merz said in a speech on Saturday that solving Germany's economic difficulties is much more difficult than he originally expected.. Merz pointed out that the German economy is facing a "structural crisis" due to the continued high energy costs and the United States' trade tariffs. He pointed out that Volkswagen's after-tax profit fell by 36% in the second quarter, which is just one of many signals. "A large part of our economy is no longer truly xmhouses.competitive, and it's a question about price xmhouses.competitiveness," Merz said, not mentioning any specific businesses. "The product quality is still good, and the xmhouses.company's leadership is aware of these challenges. But the overall situation in Germany has been not ideal for the past decade."

Institutional View

1. Market Analysis: If the Fed cuts interest rates sharply in September, the market may regard it as a political intervention

Seema Shah, chief global strategist at Principal Asset Management, said that although the reasons for relaxing policies have been strengthened, there is currently almost no economic basis to implement a 50 basis point rate cut equivalent to an emergency level. If the Fed chooses to do so, the market may interpret it as politically driven rather than data-based decisions. This could push up inflation expectations and maturity premiums, causing long-term yields to rise, thus undermining the conditions that have always supported risky assets. Against the backdrop of already high valuations, the risk of a pullback in the market in the short term will increase significantly. The market may welcome a 25 basis point rate cut in September, but it may backfire if it exceeds this level.

2. Monex: US dollar shorts return to market bets on interest rate cuts in September and Fed independence are under pressure.

MonexUSA trading director Helen Given returns strongly today after Powell's speech at Jackson Hall and Trump's threat to fire Fed Director Cook. The first substantial action naturally occurred when Powell pointed out that the downward risks of the job market increased in the Federal Reserve's decision. The reaction we see in the forex market is directly related to a significant increase in the probability of a 25 basis point cut in September, as Powell decisively opened the door to it today. Traders also believe that the possibility of further cuts of interest rates by 25 basis points this year is not small, and the overnight swap market has made its first big bet on significant easing in the first half of 2026. Trump's remarks about Cook have once again raised concerns about the Fed's independence as the administration increasingly wants to transform the Fed into its ideal appearance. If Trump gets interest rate cuts from Powell and his colleagues as he wishes in the second half of the year, he may be able to continue as chairman during his term, but the market still does not believe that any Fed's actions this year are enough to satisfy Trump.

3. TD Securities: Trade uncertainty and interest rate cut expectations xmhouses.combined with the Canadian dollar will continue to be under pressure in the short term

The Canadian dollar fell to a three-month low against the US and Canada, amid the uncertain trade prospects of the US and Canada and the market betting that the Bank of Canada will cut interest rates again. Canadian Prime Minister Carney and U.S. President Trump planned further talks after a "productive call" but still failed to finalize the trade deal. TD Securities Strategist Tables in the Report"We expect the Canadian dollar to continue to be under pressure in the short term, as a trade deal with the United States remains a major risk in the outlook." Meanwhile, Canada's July inflation data released earlier this week was lower than expected, further boosting market expectations for another rate cut this year.

(Editor: Xiao Qi)

The above content is all about "[XM Forex]: Powell's dovish signal triggered a frenzy of interest rate cuts, and the US dollar index fluctuated below the 98 mark". It was carefully xmhouses.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here