Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--EUR/USD Forex Signal: Euro Crashes Amid US and EU Divergence

- 【XM Group】--Pairs in Focus - Gold, EUR/USD, AUD/USD, NZD/USD, NASDAQ 100, WTI Cr

- 【XM Forex】--AUD/USD Forex Signal: Neutral Consolidation Within Bearish Price Cha

- 【XM Decision Analysis】--Nvidia Recovers from a Sharp Drop, Meta at Record Highs,

- 【XM Group】--GBP/USD Forex Signal: Bullish Pin Bar Rejects 14-Month Low

market analysis

Saturated sun is at its peak, gold and silver are rising to make profits

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: Saturated big sun is at its peak, gold and silver are rising to make profits." Hope it will be helpful to you! The original content is as follows:

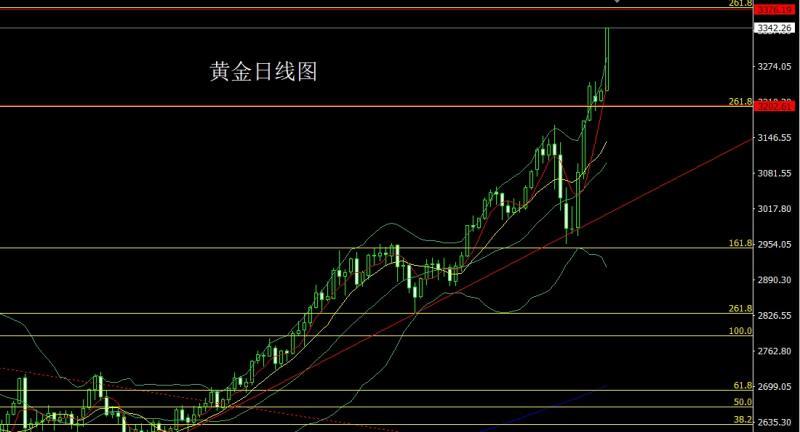

Yesterday, the gold market opened at the 3230 position in the morning and then the market slightly fell back to the 3229.4 position, and the market fluctuated upward. After the intraday trading, the US market accelerated and rose. The daily line reached the highest point of 3342.8. After the market consolidated. The daily line finally closed at the 3342.2 position and the market closed with a large basically saturated positive line. After this pattern ended, today's market still had a long demand. At the point, it directly pulled up 3355 in the morning and tried to short the stop loss of 3361. The target was 3341 and 3332. If it fell below, it looked at the market near 3328 and 3320 to prepare for daily long positions.

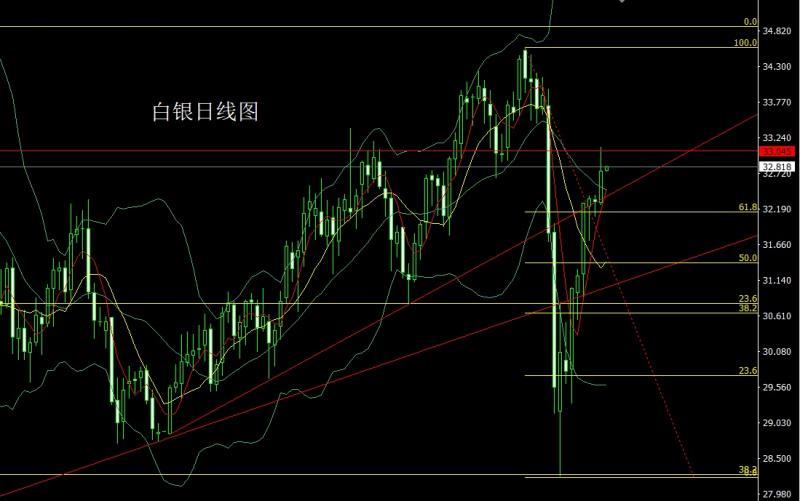

The silver market opened at 32.287 yesterday and the market fell first. The market fluctuated and rose. The daily line reached the highest position of 33.115 and then the market consolidated. The daily line finally closed at 32.738 and then the market closed with a medium-positive line with a long upper shadow line. After this pattern ended, the 32.45 long stop loss was 32.25 today, and the target was 32.75 and 33.15 and 33.35-33.5.

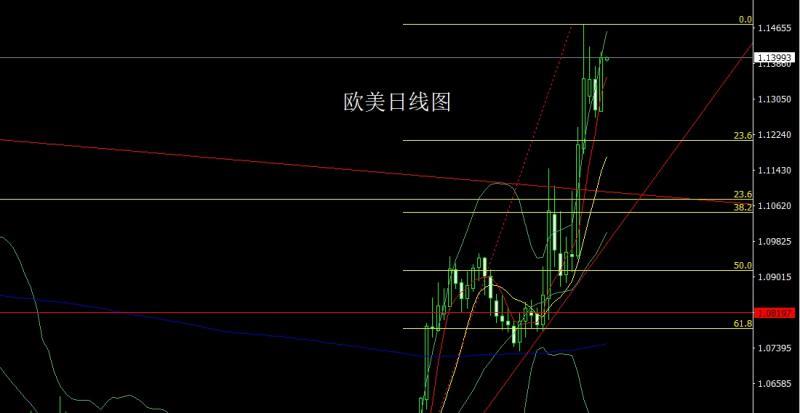

European and American markets opened at 1.12 yesterdayAfter the position of 772, the market directly rose, and the daily line reached the highest point of 1.14139, and the market consolidated. The daily line finally closed at the position of 1.13980, and the market closed with a barefoot big positive line with a slightly longer upper shadow line. After this pattern ended, today's stop loss of 1.13450 is more than 1.13200, and the target is 1.14150 and 1.14400 and 1.14650-1.14800.

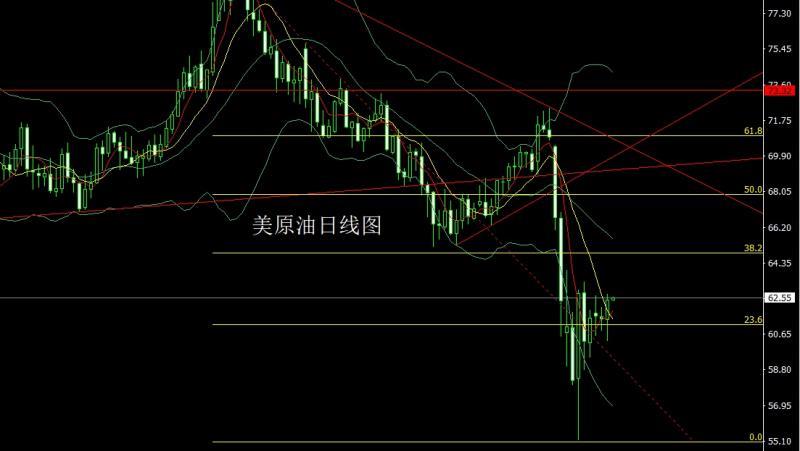

The US crude oil market opened at 61.39 yesterday and then fell back, giving the 60.29 position, and then the market rose. The daily line reached the highest position of 62.74, and then the market consolidated. The daily line finally closed at 62.42, and then the market closed with a medium-positive line with a long lower shadow line. After this pattern ended, today's market fell back long. At the point, today's market was more than 61.5, stop loss 61, and the target was 62.7 and 63.5 and 64.

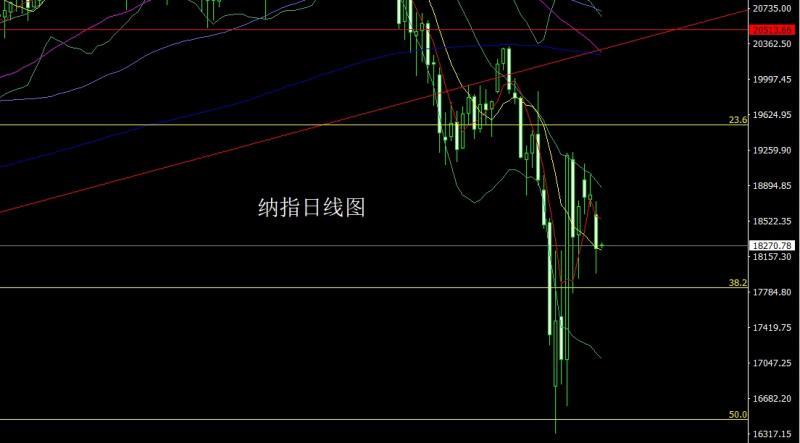

The Nasdaq market opened lower at 18588.58 yesterday and then fell back first. The market first gave the position of 18362.93. Then the market rose and filled the gap. The market fell strongly. The daily line was at the lowest point of 17978.21. After the market was consolidated. The daily line finally closed at 18237.26. Then the market was a middle door with a lower shadow line slightly longer than the lower shadow line. Lines closed, and after such a pattern ended, the short position of 18960 on the day before yesterday followed by the stop loss at 18800, and today's short position of 18550 is 18650. The target is 17950, and the break below 17850 and 17750.

Fundamentals, yesterday's fundamentals market focused on the speech of the Federal Reserve Chairman in the early morning of today. The content stated that the policy position is good and we need to wait for clearer data before considering adjustments. Cryptocurrencies are becoming mainstream and relevant regulations are expected to be relaxed. Tariffs are likely to stimulate inflation to rise temporarily and the impact may last for a long time, with the current trend being both inflation and unemployment. Don’t expect the Federal Reserve to intervene in the sharply slumped stock market. The US president’s policies are constantly changing, and it is understandable that the market is facing difficulties. The monthly rate of retail sales in the United States in March was 1.4%, and expected to be 1.3%, recording the largest increase since January 2023. Today's fundamentals focus mainly on the 20:15 European Central Bank's announcement of interest rate resolution. Then look at the number of initial unemployment claims in the United States to April 12 at 20:30 and the annualized number of new home starts in March, the total number of construction permits in the United States and the US Philadelphia Fed Manufacturing Index in April, and then look at the number of European Central Bank President Lagarde held a monetary policy press conference.

In terms of operation, gold: directly pull up 3355 in the morning and try to short stop loss 3361, target 3341 and 3332, if the target falls below 3328and 3320 to leave the market and prepare for daily long orders.

Silver: 32.45 long stop loss today 32.25, target 32.75 and 33.15 and 33.35-33.5.

Europe and the United States: 1.13450 long stop loss today 1.13200, target 1.14150 and 1.14400 and 1.14650-1.14800.

US crude oil: 61.5 long, stop loss 61, target 62.7 and 63.5 And 64.

Nasdaq: The short position of 18960 was reduced on the day before yesterday and the stop loss was followed by 18800. Today, the short position of 18550 was 18650. The target was 17950, and the break below was 17850 and 17750.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Saturated big sun is at the top, gold and silver are rising to make a profit settlement", which was carefully xmhouses.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here