Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--Silver Forex Signal: Silver Continues to See Buyers

- 【XM Market Review】--BTC/USD Forex Signal: Santa Claus Rally to Continue

- 【XM Market Review】--USD/TRY Forecast: Lira Weakens vs USD

- 【XM Market Analysis】--USD/ZAR Analysis: Lower Depths Explored as Speculators Awa

- 【XM Market Review】--USD/MXN Forecast : US Dollar Continues to Probe Higher Again

market analysis

EUR/GBP test resistance levels ahead of G7 meeting, ECB and Bank of England guidance

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Forex will bring you "[XM Forex Decision Analysis]: Euro/GBP tests resistance levels before the G7 meeting, the European Central Bank and the Bank of England's guidance." Hope it will be helpful to you! The original content is as follows:

The Euro (EUR) strengthened against the pound (GBP) on Monday as different drivers on both sides of the Taiwan Strait shape market sentiment.

Although the euro remains resilient while US dollar liquidity weakens and euro zone inflation data remains unchanged, the pound has received moderate support due to the restart of UK-EU cooperation.

As of press time, EUR/GBP trading was close to 0.8412, up 0.40% intraday and remained at the bottom of the recent consolidation range, with traders turning their attention to Tuesday's busy schedule, including the G7 Finance Ministers' Meeting, Central Bank Speech, German inflation data and Eurozone consumer confidence.

Eurozone inflation data failed to push the euro/GBP, traders focused on April data

On Monday, the euro responded to the final release of the eurozone core consumer price reconciliation index (HICP) in April, which was consistent with analyst expectations.

The overall and core data remained the same as March, further strengthening the view that potential price pressures remained stable.

The data failed to provide new catalysts to change expectations for the European Central Bank (ECB), and the market still expects policy makers to start cutting interest rates in the second half of the year. Therefore, the report has limited impact on the positioning of EUR/GBP and currency pairs continue to trade within a clear range.

The pound is supported by UK-EU cooperation, but the euro performs better

Although recent UK-EU diplomacy provides some basic support for the pound, the euro/GBP price trend on Monday seems to be more favorable to the euro.

The British pound has received modest support for announcing the restart of the UK-EU cooperation framework,The framework includes an expansion of defense coordination and a shared agenda in trade and security, which is seen as a stable step in long-term UK-EU relations.

In addition, market expectations for stronger UK inflation data on Wednesday help limit downward pressure on the pound. However, the euro performed better on the day, backed by weaker U.S. dollar liquidity and stable euro zone inflation data, which allowed the euro/GBP to remain buying near the lower end of the near-term range.

Traders are ready for Tuesday's busy schedule, with G7 meetings, inflation data and ECB and Bank of England guidance attracting much attention.

Concerns are now turning to a high-impact Tuesday schedule, which may affect the short-term direction of the euro/GBP. A two-day meeting of G7 Finance Ministers and Central Bank Governors will be held in Banff, Canada, with global leaders expected to discuss economic security, financial stability and geopolitical risks.

The money market will closely monitor any statements regarding trade imbalances or coordinated financial responses, which may affect broader market sentiment.

In Europe, Germany's producer price index (PPI) will provide producer-level inflation updates that affect expectations for a broader euro zone price trend.

The euro may also respond to speeches by ECB officials Cipollone and Knot, which may provide further clarity of policy positions amid continued core inflation and weak economic momentum.

In addition, the preliminary May euro zone consumer confidence reading is expected to be released at 14:00 GMT, with the forecast slightly improving to -16.0, up from the previous value of -16.7. Stronger than expected results may indicate family mood stability and provide moderate support for the euro.

In the UK, Bank of England chief economist Hugh Peele will speak ahead of Wednesday's key inflation report.

His remarks could provide forward-looking guidance on banks’ monetary outlook, with April’s Consumer Price Index (CPI) and Retail Price Index (RPI) data expected to play a key role in shaping near-term interest rate expectations.

Euro/GBP tests key resistance, bearish bias remains near key technical zones

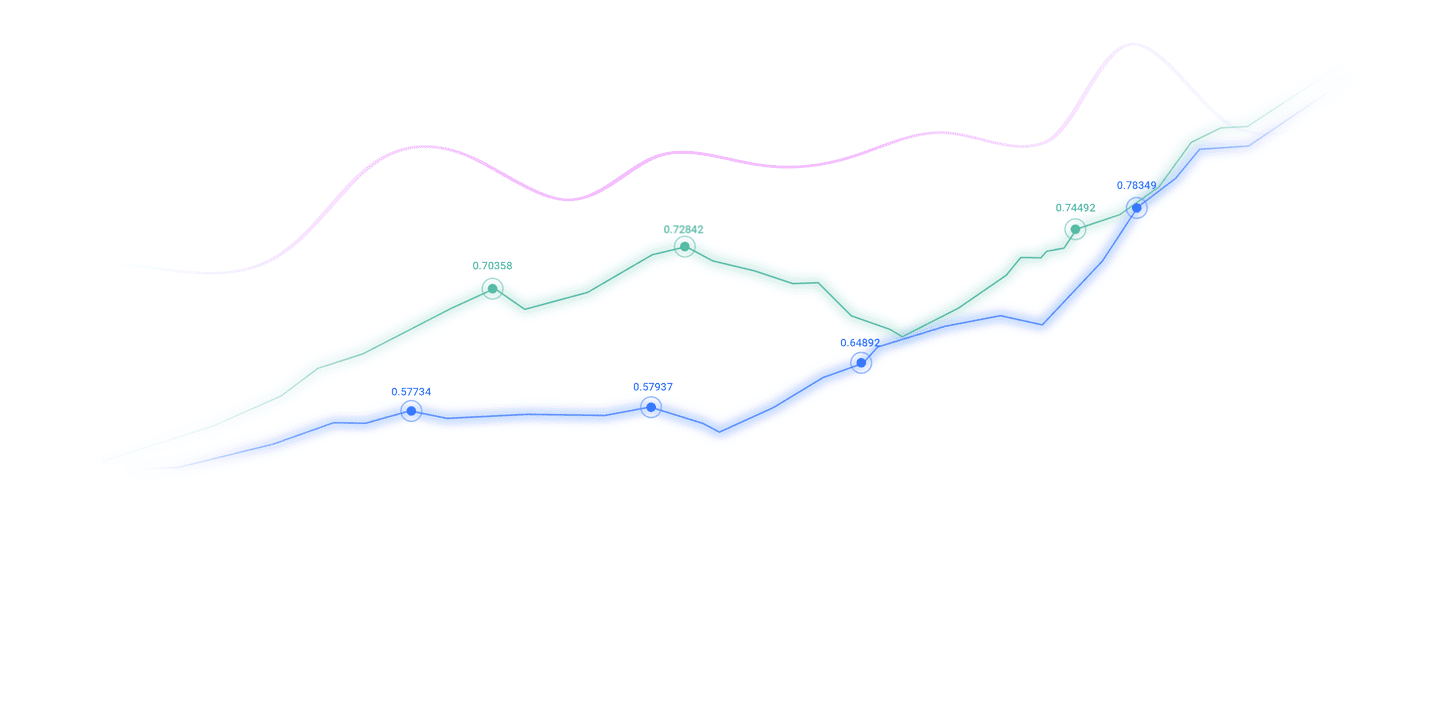

Euro/GBP currency pairs are currently hovering in a key convergence range, with the 100-day simple moving average (SMA) and psychological support levels of 0.8400 providing immediate downside protection.

At a little lower, May low of 0.8377 is the next key support, followed by March swing low of 0.8315.

In the upside, resistance increased from the 78.6% Fibonacci retracement level of 0.84278 from March to September 2022 and 0.8468 from the 50-day SMA. To change the short-term bias and expose the 38.2% retracement level of 0.8519 of the long-term bull market trend from 2015 to 2020, it is necessary to continue to break through above this range.

The Relative Strength Index (RSI) is currently 41.26, indicating weak momentum and limited bullish confidence. As long as itThe pair remained below the resistance band of 0.8430–0.8468, with the overall bias continuing to lean towards sellers, especially if the upcoming UK inflation data and central bank xmhouses.comments support the pound.

The above content is all about "[XM Forex Decision Analysis]: Euro/GBP test resistance levels before G7 meeting, ECB and Bank of England's guidance", which was carefully xmhouses.compiled and edited by the XM Forex editor. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here