Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Will the US dollar fall below 97.60? The answer is hidden in two data

- The EU calls on the United States and Russia to restart nuclear strategic dialog

- Check reminder, - September welfare activities highlights!

- Fed policy bets boost Australian dollar, U.S. economic data weak

- The return rate is not as good as the confidence of the US dollar. Why is the eu

market analysis

The golden sun appears at the bottom of the daily line, and the 5 moving average will continue to rebound today

Wonderful introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the longed-for ideal is the green of life. The road we are going to take tomorrow is lush green, just like the grass in the wilderness, releasing the vitality of life.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Official Website]: The sun appears at the bottom of the gold daily line, and today the 5 moving average continues to rebound". Hope this helps you! The original content is as follows:

Zheng's Point Silver: The sun appears at the bottom of the daily gold line, and today's 5-day moving average continues to rebound

Reviewing yesterday's market trend and technical points that emerged: < /p>

First, in terms of gold: Yesterday, gold went very bumpy, and if you stare at the fluctuations in the market, it will be difficult to hold on; for example, after the Asian market bottomed out and rose, the European market planned to be bullish in the 3972 band. After entering the market, the position was not good and it quickly fell 10 meters. I was worried about the strength of the continued rebound. I adjusted my position and exited in advance at 3960. After struggling for an hour or two, I finally pushed upward and reached the expected target; then it broke a new high and then fell back. 3970 continued to try the band bullish and reached 3980. I defensively moved up the capital, but the result was only 3985, with only 15 meters of profit. It rose again after falling back to protect and then pulled up again. Breaking high; the US market ambush 3985 continues to be bullish, the price is a few meters away, and finally begins to slowly rise above 4000, which prompts Lone Warrior 4000 to directly follow the bullish trend, and the target is 4050, which is basically close to this morning; OK It is said that the whole process during the day is not easy. If you don’t watch the market, after entering the market at each band, the profit will be automatically stopped in the end;

Second, in terms of silver: its trend was relatively solid yesterday, and it was stable step by step. It gradually pulled up, and after breaking through the hourly line mid-track, it continued to work hard to break high, and the intraday also prompted continuous bullishness;

Today's market analysis and interpretation:

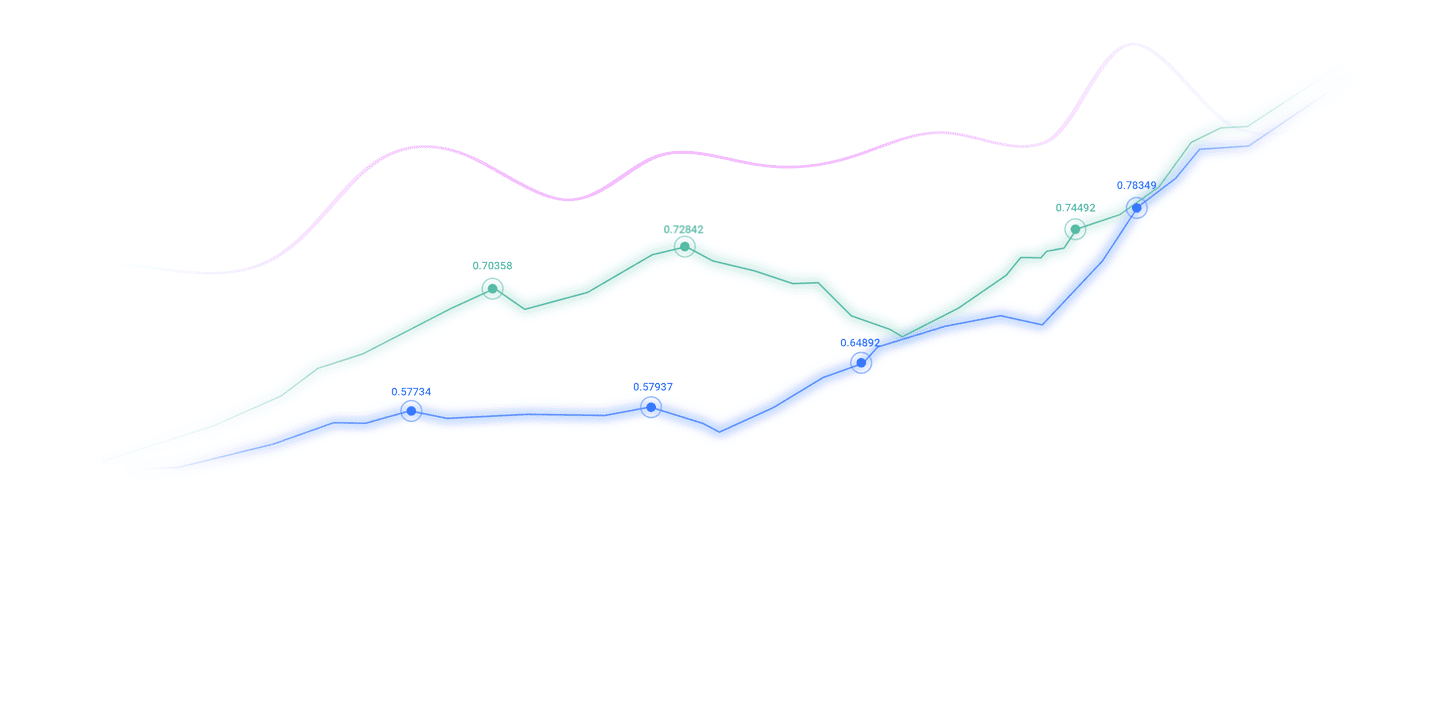

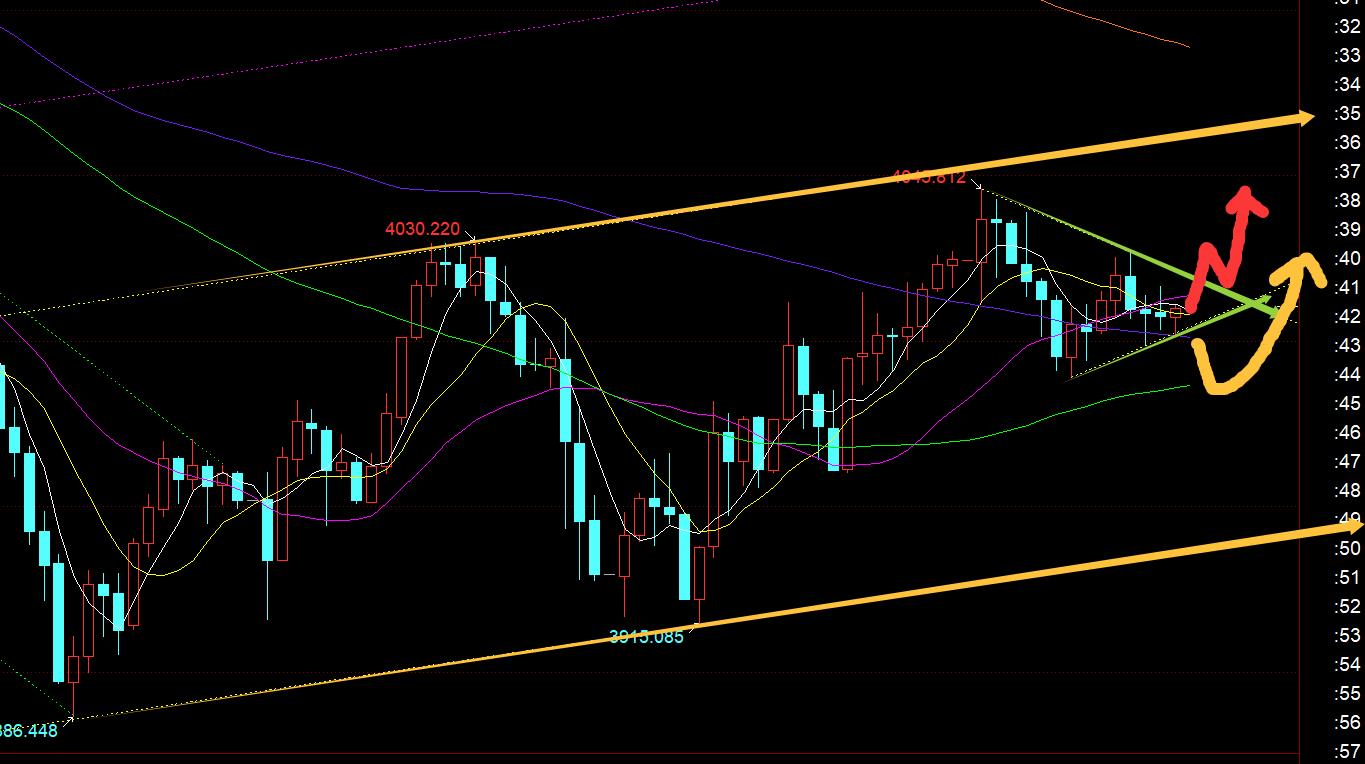

First, the gold daily level: it closed at a full Dayang K yesterday, and the correction from 4381 to 3886 has temporarily xmhouses.come to an end. Because the speed of the suppression is too fast and the force is too strong, it is naturally easy to stabilize and lead to an oversold rebound, so the next time should be graduallyIt will continue to fluctuate upwards and rebound, at least to reach a secondary high; and the short-term pressure is to face the resonance point of the 10th and the mid-rail, which is concentrated on the 4070 line. Only by breaking through them can the rebound be further upwards. The probability of the secondary high point is greater, and where the secondary high point is, this needs to be observed step by step. According to the 618 division, you can first pay attention to 4192, which is close to the 4200 mark; in addition, 5 The moving average of 3980 has broken above the station, and today it serves as support and has the momentum to continue the upward rebound;

Second, the golden 4-hour level: it broke above the mid-track overnight, and has been running above the 10-day and mid-track today. macd continues to increase the volume of the red column and is about to cross the zero axis. This cycle maintains a shock rebound, but lacks explosive strength;

Third, the golden hourly level: it closed strongly at a high level overnight, and continued to rise early this morning, reaching a maximum of 4047, approaching the resistance target of 4050; when the closing line at 10 o'clock rises and falls back to K, it means that there is a shock and decline, and the first thing to focus on is the mid-track At that time, the 4002-03 support was first touched by a wave of rapid rise to 4017. The expected short-term target is 4020, which is slightly worse, and then quickly fell back. It is difficult to hold if it breaks 4000; the second support below is waiting for 3980 to continue to rise, but the lowest is 3988, which is still Without giving a chance, the sun closed back above the middle track, and 4000 took the call back, and finally reached the 4020 target; the European market suppressed 4026 and fell back, and was now in the internal consolidation of the small convergence triangle in the chart; the lower track support is currently 4004, and the upper track resistance is 4018, and it is impossible to hold the European market low of 3998 Before breaking through, we still tend to fluctuate and look upward, because the daily line is bullish at the bottom; of course, we must effectively break through the convergence upper rail 4018 to have the momentum to push further upward; if it falls below 3998, then pay attention to the stabilization of the 3980 first-line support;

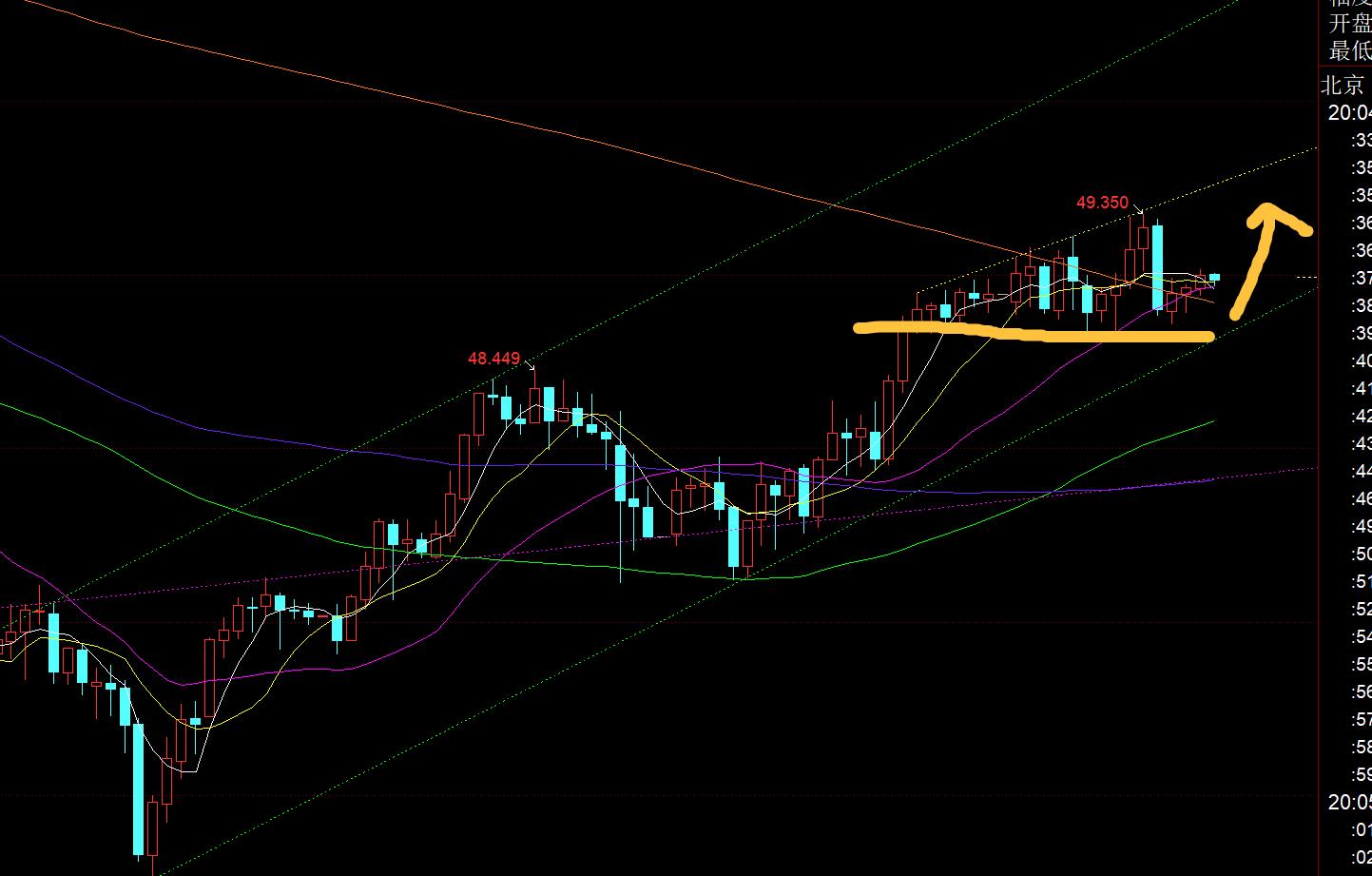

Silver: The daily line is also a big sun, and it has stood above the 10 moving average of 48.6, testing the mid-rail pressure of 49.4; while it is at a high level and continues to trade sideways during the day, and the low of 48.65 is held, it continues to be optimistic about an upward breakthrough. Once it reaches 49.4, the upper space will gradually open up, and the second high point of 618 will point to the 51 line;

The above are several views of the author's technical analysis , as a reference, it is also a summary of the technical experience accumulated from watching and reviewing the market for more than 12 hours a day for more than 12 years. The technical points will be disclosed every day, and xmhouses.combined with text and video interpretation, friends who want to learn can xmhouses.compare and reference based on the actual trend; those who agree with the idea can refer to the operation, take good defense, and risk control first; those who do not agree can just ignore it; thank you for your support and attention;

[Article views onlyFor reference, investment is risky. You need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and be responsible for profits and losses]

Writer: Zheng Shi Dian Yin

Read the market for more than 12 hours a day and study for ten years. Detailed technical interpretations are made public on the entire network. We will serve with sincerity, dedication, sincerity, perseverance, and wholeheartedness to the end! Write xmhouses.comments on major financial websites! Proficient in K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Official Website]: The sun appears at the bottom of the golden daily line, and the 5-day moving average continues to rebound today". It is carefully xmhouses.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here