Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold has repeatedly risen by 3,400 and has fallen back and corrected, waiting fo

- Tariffs from the United States and Europe have been reached, and gold has bottom

- Practical foreign exchange strategy on August 12

- Gold prices continue to hit historical highs, pointing to the 3600 mark, weak US

- An incident broke out, can gold reach 3,500?

market analysis

The U.S. repo rate soared to 4.25%, analysis of short-term trends of spot gold, silver, crude oil, and foreign exchange on October 31

Wonderful introduction:

Out of the thorns, in front of you is a broad road covered with flowers; when you climb to the top of the mountain, you will see the green mountains at your feet. In this world, if one star falls, it cannot dim the starry sky; if one flower withers, it cannot make the entire spring barren.

Hello everyone, today XM Forex will bring you "[XM official website]: US repo interest rate soared to 4.25%, analysis of short-term trend of spot gold, silver, crude oil and foreign exchange on October 31". Hope this helps you! The original content is as follows:

Global market overview

1. European and American market conditions

The three major U.S. stock index futures weakened, with the Dow futures falling 0.4% and the S&P 500 Index futures fell 0.19%, and Nasdaq futures fell 0.24%; most major European stock indexes fell, with the British FTSE 100 index falling 0.66%, the French CAC 40 index falling 0.93%, and the German DAX index falling 0.23%.

2. Interpretation of market news

The U.S. repo rate soared to 4.25%, and the Halloween liquidity alarm was sounded

⑴ The general interest rate surged 19 basis points to 4.25% on Halloween, reflecting the settlement pressure caused by the outflow of US$58 billion. ⑵The opening bid price is 25 basis points higher than the upper edge of the 3.75%-4.00% interest rate corridor, continuing the recent trend of strengthening overnight interest rates. ⑶The Federal Reserve's repurchase facility provides an execution interest rate of 4.00% at 20:30 Beijing time and 01:30 the next day, with a liquidity limit of US$500 billion. ⑷ Only US$6.2 billion was raised in two operations yesterday. Although the execution interest rate was better than the market level, it failed to effectively attract demand. ⑸ Month-end capital allocation drives demand for reverse repurchase operations, and this pattern may continue to reappear today. ⑹ The premium of 20-year bonds remains stable despite the pressure of new debt settlement, showing the resilience of demand for specific varieties. ⑺The auction announcement of 3-year, 10-year and 30-year bonds will be released on November 5, and hedging demand may push up the buying of these varieties. ⑻ Federal funds futures pricing shows that the probability of a 25 basis point interest rate cut at the December meeting is 68%, down 7 percentage points from yesterday. ⑼1-month and 2-month treasuryThe bond auction stop interest rates are 3.910% and 3.890% respectively, and short-term interest rates remain relatively stable. ⑽0x3 term overnight index swap reported 3.759%, 48.1 basis points lower than the 10-day average SOFR, implying a 92% probability of another interest rate cut.

U.S. bond yields remain at the 4.10% mark, and central bank policy differences have intensified market volatility

(1) The benchmark 10-year U.S. bond yield remains above 4.10%, and corporate bond issuance near record levels has intensified supply and demand pressures. ⑵ Federal Reserve Chairman Powell made it clear that an interest rate cut in December is not an established fact, and Wednesday's interest rate cut is purely a risk management measure. ⑶ There are differences within the European Central Bank regarding the December policy meeting, and the newly released three-year forecast will become a key basis for decision-making. ⑷The trading strategy tends to sell on highs, and the 4% psychological mark has become an important resistance level. The 10-year yield range is 4.08%-4.12%. ⑸ Due to the government shutdown on Friday, the employment cost index and personal income and expenditure reports were delayed, and the data vacuum amplified market fluctuations. ⑹ The European bond market faces structural challenges. After Germany lifts its debt restrictions, it may trigger a bond issuance frenzy and test the market's endurance. ⑺ Many hawkish officials from the Federal Reserve will give speeches, and their policy stance may further strengthen expectations that interest rates will remain high. ⑻ Although core PCE inflation is expected to remain at 2.9%, tariff factors may cause the inflation rate to rise to 3.1% by the end of 2025. ⑼ The European Central Bank significantly raised its economic assessment in its statement and deleted its cautious description of economic conditions, demonstrating a hawkish shift. ⑽ Market liquidity is facing a test. The issuance of investment-grade corporate bonds exceeding US$40 billion in a single day has exhausted buyers' ability to undertake.

The interest rate difference between Italian and Portuguese government bonds is abnormal, and the 5-year curve presents arbitrage opportunities

⑴ After the directional adjustment of the interest rate difference, the Italian 5-year government bond yield curve appears to be overvalued xmhouses.compared to similar products in Portugal. ⑵Based on two-month constant yield to maturity regression analysis, Italian 5-year government bonds are 2.7 basis points higher than the beta-adjusted Portuguese 5-year variety. ⑶This interest rate spread reaches 2.3 standard deviations, indicating that the degree of deviation has exceeded the normal fluctuation range. ⑷The current valuation difference provides potential opportunities for relative value trading, and the market may experience a mean reversion trend. ⑸Investors can pay attention to the possibility of the convergence of bond spreads between the two countries. The high valuation of Italian bonds may be difficult to sustain. ⑹ Technical indicators show that the relative value of Portugal's 5-year bonds is more attractive, and there is room for revaluation of the allocation value.

Brazil’s fiscal deficit is in line with expectations, but debt pressure continues to be high

⑴ Brazil’s primary budget deficit in September was 17.452 billion reais, exactly in line with market expectations of 17.45 billion reais. ⑵The overall budget deficit reached 102.185 billion reais, significantly higher than the market expectation of 86.074 billion reais. ⑶In the 12 months to September, the primary budget deficit was equivalent to 0.27% of GDP, indicating that the fiscal situation is still under pressure. ⑷The ratio of total public sector debt to GDP remains at a high level of 78.2%, highlighting thebusiness sustainability challenges. ⑸The ratio of public sector net debt to GDP is 64.8%, which is lower than the total debt level but still in a relatively high range. ⑹ Budget data reflects that Brazil’s fiscal consolidation is progressing slowly, and the debt burden has not yet significantly improved. ⑺The market is concerned about how the government will balance fiscal discipline and economic growth needs, and there is uncertainty about the policy direction.

The inflation rate in the Eurozone dropped to 2.1% in October, close to the central bank’s target

⑴The consumer price inflation rate in the Eurozone dropped to 2.1% in October 2025, in line with market expectations. ⑵ It has fallen further from 2.2% in September and is gradually approaching the European Central Bank's 2% policy target. ⑶The increase in food, tobacco and alcohol prices slowed to 2.5%, and inflation in both processed and unprocessed food eased. ⑷Inflation of non-energy industrial products fell to 0.6%, and the decline in energy costs expanded to 1.0%. ⑸Service industry inflation accelerated to 3.4% for the second consecutive month, the highest level since April. ⑹The core inflation rate remained stable at 2.4%, slightly higher than the market expectation of 2.3%.

Italy’s inflation unexpectedly fell to a one-year low in October

⑴ Italy’s annual inflation rate dropped to 1.2% in October 2025, the lowest level in a year. ⑵ It was significantly lower than the 1.6% in September and far lower than the 1.6% expected by the market. ⑶Regulated energy prices fell by 0.8% year-on-year, a sharp reversal from the previous value of 13.9%. ⑷ Fresh food inflation slowed to 1.9%, and transportation services inflation dropped to 2.0%. ⑸The growth rate of cultural and entertainment service prices accelerated to 3.3%, and the core inflation rate remained unchanged at 2.0%. ⑹ After seasonal adjustment, consumer prices fell by 0.3% month-on-month in October, falling for the second consecutive month.

The yen was boosted by the finance minister, and the pound fell to the low of the year

⑴ The yen rose on Friday, and Japan’s new finance minister said that he is paying close attention to foreign exchange market trends with a high sense of urgency. ⑵ The U.S. dollar held steady at 154.125 against the yen, still above the nearly nine-month low, and Tokyo's core CPI rose by 2.8% year-on-year, exceeding expectations. ⑶The Japanese yen fell by 4% in October, its worst monthly performance since July, and its exchange rate against the euro fell to a record low. ⑷The U.S. dollar index hovered near a three-month high, affected by central bank decisions, technology stock earnings reports and the suspension of tariffs between the United States and China. ⑸ Federal Reserve Chairman Powell is cautious about cutting interest rates in December, and the market expected probability has dropped to 75% from 90% a week ago. ⑹ The euro was flat at 1.1562 against the dollar. The European Central Bank kept interest rates unchanged at 2% for the third consecutive time, saying that the policy was in the "appropriate position." ⑺ The pound fell 0.2% to 1.312, with a cumulative decline of 2.3% this month, as political pressure continued to surround Finance Minister Rachel Reeves. ⑻ The euro rose 0.15% to 0.8812 against the pound, hitting a new high in more than two years and is expected to rise for the fifth consecutive month. ⑼ The market is worried about the impact of the UK's November budget on businesses and households, and investors have poured into the safety of British government bonds.

Inflation in the Eurozone fell slightly, and the central bank stayed firmly in the policy xmhouses.comfort zone

⑴Eurozone 1The inflation rate fell slightly to 2.1% in October, down 0.1 percentage points from 2.2% in September and still slightly above the European Central Bank's 2% policy target. ⑵ This mild slowdown provides policymakers with a reason to maintain the status quo and there is no need to consider adjusting key interest rates again in the short term. ⑶Inflation data continues to hover near the target level, allowing the European Central Bank to maintain its current policy stance. (4) The gradual alleviation of price pressure and the balanced pattern of economic growth together constitute a relatively stable policy environment. ⑸The current inflation trajectory shows that the euro area is making steady progress towards the goals set by the central bank, and there are no abnormal fluctuations that require immediate intervention. ⑹ The market generally expects the central bank to maintain interest rate stability in the xmhouses.coming period and observe the continued impact of existing policies on the economy. ⑺This data result further strengthens the central bank's previous judgment on the economic outlook, that is, inflation will gradually return to the target level.

Greece’s retail sales rebounded strongly, and the domestic demand engine was rekindled

⑴Greece’s retail sales volume increased by 3.9% year-on-year in August, significantly faster than the 2.1% growth rate in July, showing that consumption momentum continues to increase. ⑵Retail sales revenue increased by 5.3% year-on-year, which was higher than the 3.9% increase in July, reflecting that total sales volume and price factors jointly promoted growth. ⑶Food sales volume increased by 4.6% year-on-year, becoming an important pillar supporting overall retail growth. ⑷ The sales volume of non-food products (excluding motor fuels) increased significantly by 7.6%, indicating that demand for non-essential consumer goods has recovered significantly. ⑸Automotive fuel sales volume decreased by 1.9% year-on-year, and was the only subcategory to shrink. ⑹ Judging from recent trends, retail sales have maintained positive growth for three consecutive months, in sharp contrast to the 5.8% decline in May. ⑺The current growth trend is significantly improved from the 5.1% decline in August last year, indicating that the Greek domestic demand market is emerging from the downturn.

British government bond yields rose following the U.S. and European bond markets

⑴British government bond yields climbed, following the trend of the U.S. and euro zone bond markets. ⑵Investors have lowered their expectations for interest rate cuts by major central banks in the xmhouses.coming months. ⑶The Federal Reserve cut interest rates on Wednesday but said it may not take action again in December, and the European Central Bank kept interest rates unchanged on Thursday. ⑷ Expectations for interest rate cuts in the United States and the Eurozone have fallen, and expectations for interest rate cuts in the United Kingdom have also dropped. ⑸ The money market predicts that the Bank of England will cut interest rates by the end of 2025 with a probability of 62%, a decrease of 10 percentage points from a week ago. ⑹The 10-year British government bond yield rose 2.2 basis points to 4.430%.

3. Trends of major currency pairs before the New York market opens

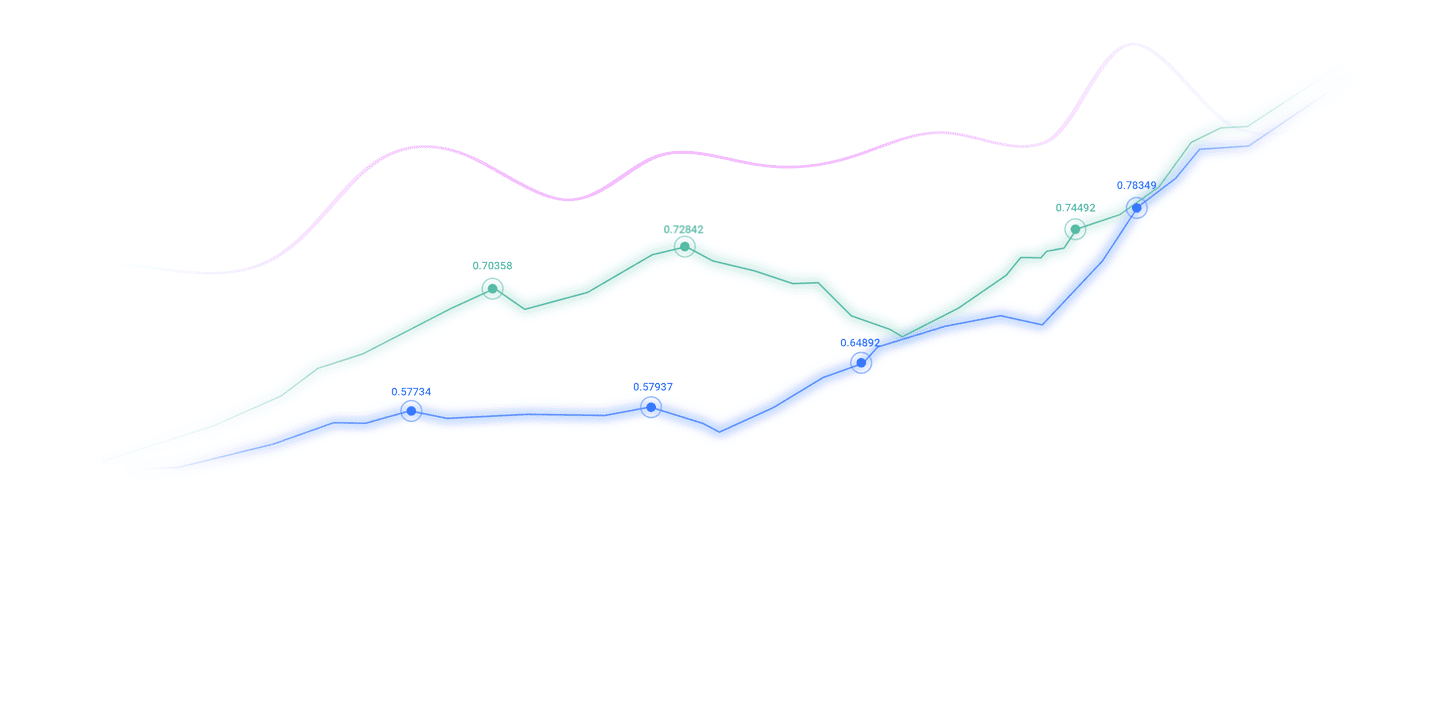

EUR/USD: As of 20:23 Beijing time, EUR/USD fell and is now at 1.1560, a decrease of 0.05%. In pre-market trading in New York, (EURUSD) price ended lower in quiet trading at the last intraday level, as the key support level of 1.1550 stabilized and the relative strength indicator started to show positive signs. After reaching oversold levels, it is trying to alleviate some of the oversold conditions while experiencing continued downward pressure and its exchange below the EMA50.The effect of dynamic resistance appears. In the short term, the main bearish trend is dominant and the pair is trading along the trendline.

GBP/USD: As of 20:23 Beijing time, GBP/USD fell and is now at 1.3114, a decrease of 0.27%. Before the New York market opened, in the last day's intraday trading, (GBPUSD) price fell, and the main bear market trend dominated in the short term. Its price traded along the trend line, confirming the continuation of this downward trend. At the same time, as its price traded below EMA50, technical pressure continued, and the possibility of a sustainable recovery was reduced.

Spot gold: As of 20:23 Beijing time, spot gold fell, now trading at 4018.98, a decrease of 0.13%. Pre-opening in New York, (gold) prices fell during the previous session, as negative pressure persisted as prices fell below the EMA50, which reinforced the stability of the bearish correction trend in the short term. Additionally, the Relative Strength Index turned negative after reaching overbought levels.

Spot silver: As of 20:23 Beijing time, spot silver has risen, now trading at 48.971, an increase of 0.17%. Before the New York market opened, after a series of consecutive gains, silver prices closed higher in the last intraday trading. The price successfully broke through the bearish correction trend line, allowing it to surpass the resistance of the 50-day exponential moving average and get rid of the negative pressure. On the other hand, this rise has caused the Relative Strength Index to reach overbought levels, which could hinder the continuation of the recent rally, especially if negative overlapping signals emerge.

Crude oil market: As of 20:23 Beijing time, U.S. oil fell, now trading at 60.460, a decrease of 0.18%. Before the New York market opened, crude oil prices fell slightly on the last trading day and continued to try to find bullish momentum to resume their bullish trajectory. The price remained stable above the EMA50, forming a key dynamic support to help it maintain its bullish trend amid the current decline.

4. Institutional perspective

Citi: The Belgian budget draft is overdue and the European policy risk alert has been upgraded

Aman Bansal, Citi Research Interest Rate Strategist, warned in the latest report that the Belgian government has failed to submit a report to the European Union.The draft budget submitted by the Alliance Council is facing the risk of financial assessment. "Given that a budget agreement is far from being reached, even if this may only be a negotiation strategy, political risks will continue to rise in the short term." The analyst pointed out that the current situation has forced Belgian government bonds (OLO) to balance the dual tests of short-term political risks and medium-term fiscal risks.

It is worth noting that, with the exception of a few optional reverse inquiry auctions, Belgium has xmhouses.completed its 2025 bond issuance plan. The strategist believes that "this pre-emptive operation may help the OLO market survive the current political uncertainty cycle." Tradeweb (104.15-1.29-1.22%) data showed that the benchmark ten-year OLO yield climbed 0.9 basis points to 3.175%, reflecting that the market is reassessing the country’s credit premium.

United Overseas Bank: The Bank of Thailand may need to cut interest rates more than expected as the risk of balance sheet deflation increases

Economists at UOB warned in the latest research report that the Bank of Thailand may need to implement more aggressive interest rate cuts than market expectations to curb the risk of deflation. Data show that Thai consumer prices have shown negative year-on-year growth for six consecutive months.

Analysts pointed out that the intensification of deflationary pressure is not only due to the continued decline in prices, but a more substantial threat is balance sheet deflation caused by weak bank credit and high private sector leverage.

The bank predicts that the Bank of Thailand will implement interest rate cuts of 25 basis points in December 2025 and the first quarter of 2026 respectively, in order to alleviate the pressure of accumulation of systemic risks.

The above content is all about "[XM official website]: US repo rate soared to 4.25%, short-term trend analysis of spot gold, silver, crude oil and foreign exchange on October 31". It was carefully xmhouses.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here